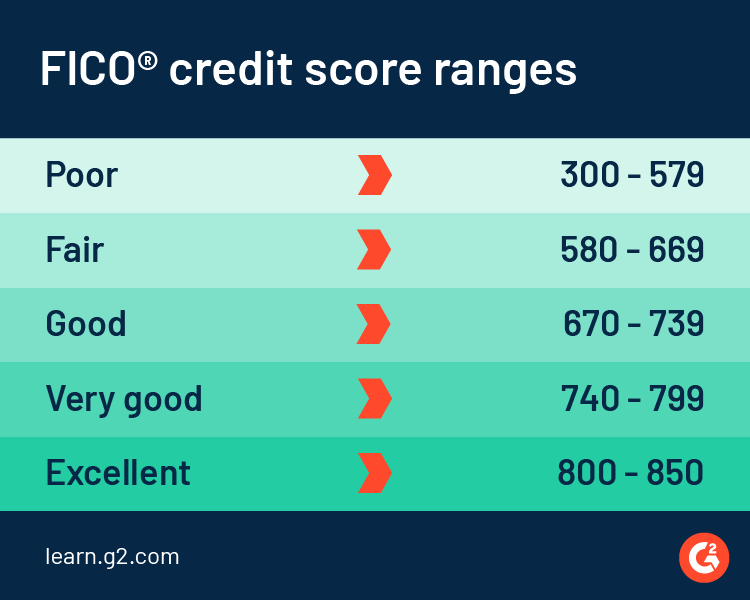

All the major credit bureaus operate internationally, though the U.S. in 2021 - not including home equity lines of credit - up 16% since 2017, according to the latest Federal Reserve data. There was $4.4 trillion in outstanding debt held by individuals in the U.S. Credit scores in the 670 to 739 range are “good” with scores above 740 being “very good” or “exceptional.” There is no standard credit score that consumers start out with, but young people building credit for the first time usually start with a score of around 645, according to July 2021 research from the Federal Reserve. Anything less than 669 is considered a “fair” or “poor” credit score, according to FICO. Ĭredit scores range from 300 to 850, with an average FICO score of 714. FICO scores are created by the publicly traded company formerly known as the Fair Isaac Corporation, which was founded in the 1950s to build a market among lenders for consumer credit information. The major credit reporting bureaus produce their own credit scores, but most lenders rely on a type of credit score known as a FICO score. But credit scores are based on those reports, and lenders often review both. Credit reports from the major reporting companies include a detailed history of debt payment and other information, such as tax liens and bankruptcy filings.Ĭredit reports typically do not include credit scores. They are for-profit enterprises not affiliated with the U.S. Innovis, the fourth largest bureau in the U.S., is used less. When a consumer goes to an auto dealer or a mortgage lender seeking money, the lender will pull a credit report from one or all of the major credit reporting bureaus: Equifax, TransUnion and Experian.

#CREDIT SCORE RANGE 2019 PLUS#

Lenders interpret a higher score as an indication they will recoup their loan, plus profit from interest paid. Lenders typically see a low score as an indication that a prospective borrower carries a high risk of default - of not being able make payments on the loan. Financial institutions use these scores to inform lending decisions for home mortgages, auto loans, personal loans and more. SeptemCredit scores: Research sheds light on how they inform lending and hiring decisions in the United Statesīy Clark Merrefield, The Journalist's Resource September 23, 2022Ĭredit scores boil down a borrower’s history of loan repayment and other factors into a three-digit number. Credit scores: Research sheds light on how they inform lending and hiring decisions in the United Statesīy Clark Merrefield, The Journalist's Resource

0 kommentar(er)

0 kommentar(er)